News

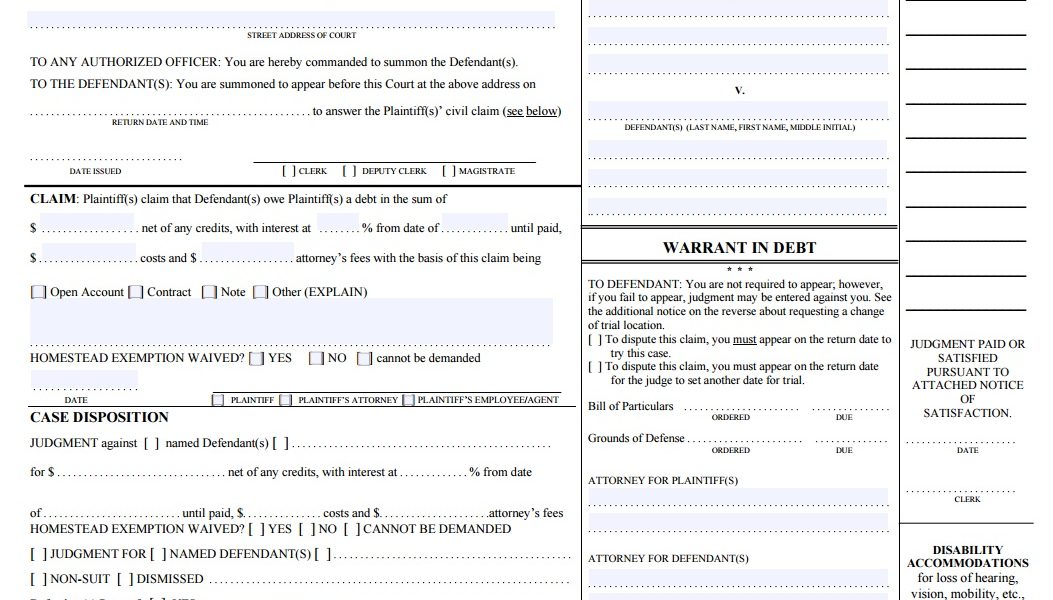

3 Reasons To Use A Private Process Server Rather Than The Sheriff

Private process servers are an important part of the debt industry, especially in states that require processing. DebtTrack.io partners with many process servers in a symbiotic relationship where there is mutual benefit between us, the process server and the end customer (debt holder). DebtTrack.io’s goal is to help modernize the Process Server industry. The article linked below explains the great

An Alternative to Payday Loans, but It’s Still High Cost

U.S. Bank, one of the country’s biggest banks, has again begun offering customers small, high-cost loans, saying the loans now have safeguards to help keep borrowers from getting in over their heads. The loans, between $100 and $1,000, are meant to help customers deal with unexpected expenses, like a car repair or a medical bill, said Lynn Heitman, executive vice

Former Banker/Regulator Wants To Allow Banks To Make Payday Loans

A powerful banking regulator appointed by President Trump could face tough questions in a Senate hearing Thursday about his efforts to allow big banks to make small, high-interest, short-term loans to consumers. Joseph Otting is a former banking executive who is now in charge of an agency that oversees the nation’s largest banks – including some that Otting used to

Mark Warner’s payday lending bill (Explained)

Payday lending is not something you’d think a major Democratic politician would want to boost. But Sen. Mark Warner (D-Va.) has gotten himself into some hot water over a bill that critics say would do exactly that.

5 Tips for Better Debt Collection

Almost every business owner comes across a difficult debtor at least once in their lifetime. Troubling economic conditions, financial mismanagement, or just plain loss of the business, there are various reasons why a customer might have difficulties meeting those debts. But, if you think of it — is it your fault? Absolutely not! This is the reason why you should

Two Democrats challenge the payday-loan industry

Could a small change in a federal tax credit significantly reduce people’s need for predatory payday loans? That’s the hope of a new tax bill introduced Wednesday by Sen. Sherrod Brown and Rep. Ro Khanna. Their topline idea is to massively expand the Earned Income Tax Credit (EITC), which gives low- and moderate-income Americans a subsidy for working. Most attention will focus